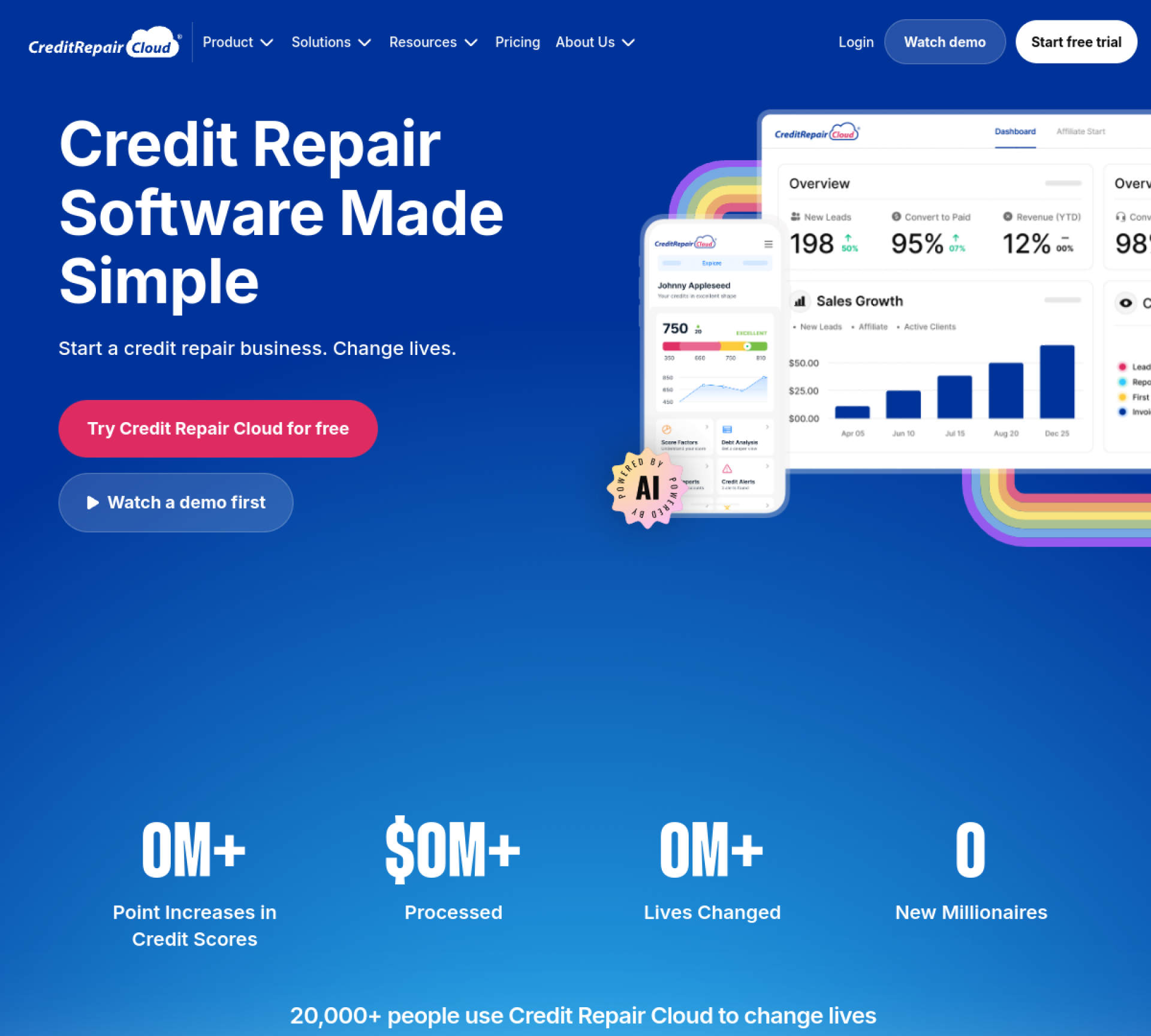

What is Credit Repair Cloud?

Credit Repair Cloud provides everything needed to start and scale a credit repair business. The platform combines client management, dispute letter automation, credit report importing, and compliance tools—turning entrepreneurs into credit repair professionals with the infrastructure to serve clients effectively.

For those looking to enter the credit repair industry or scale existing operations, Credit Repair Cloud delivers the complete business system. Founded in 2002 by Daniel Rosen, the platform has helped launch over 20,000 credit repair businesses worldwide, making it the most widely adopted solution in the industry.

Start Your Credit Repair BusinessKey Features

Client Portal

Branded client portal lets customers track their credit repair progress. Secure document upload, dispute status tracking, and communication tools keep clients engaged and informed. The portal displays real-time credit score changes, dispute outcomes, and upcoming actions—reducing client inquiries while building trust through transparency.

Automated Dispute Letters

Access proven dispute letter templates covering common credit issues. The system generates customized letters based on credit report items, streamlining the dispute process. The library includes over 100 professionally crafted letters targeting specific creditor types, collection agencies, and bureau-specific disputes. Letters automatically populate with client information and disputed item details.

Credit Report Import

Import credit reports from all three bureaus directly into the system. Automated analysis identifies disputable items and prioritizes high-impact opportunities. The software parses report data to highlight late payments, collections, charge-offs, and inquiries that may be eligible for removal. Integration with major credit monitoring services enables seamless data flow.

Compliance Tools

Built-in compliance features help navigate credit repair regulations. Contract templates, disclosure requirements, and state-specific guidance reduce legal risk. The platform stays current with CROA (Credit Repair Organizations Act) requirements and provides audit-ready documentation for every client interaction.

Business Management

Billing automation, team management, and reporting tools support business growth. Track revenue, manage affiliates, and scale operations systematically. The dashboard provides real-time metrics on client acquisition, retention rates, average revenue per client, and team performance. Automated invoicing and payment processing eliminate manual billing tasks.

Training & Support

Comprehensive training library teaches credit repair techniques and business building. Community support connects practitioners for shared learning. The Credit Hero Challenge program provides step-by-step guidance for launching a credit repair business in 30 days, while advanced courses cover scaling strategies and niche market development.

CRM and Lead Management

Built-in CRM tracks every prospect and client interaction. Capture leads from your website, track follow-up activities, and automate nurture sequences. The system scores leads based on engagement and converts prospects to paying clients with automated workflows.

Affiliate Management System

Build referral networks with the integrated affiliate portal. Track commissions, manage payouts, and provide marketing materials to partners. Affiliates access their own dashboard to monitor referrals and earnings, creating passive revenue streams for your business.

Pricing

Start — $179/month. 3 team members, up to 300 active clients. Includes all core features, unlimited storage, affiliates, and leads.

Grow — $299/month. 6 team members, 600 active clients. Same features with higher capacity.

Scale — $399/month. 12 team members, 1,200 active clients. Advanced automation for larger operations.

Enterprise — $599/month. 24 team members, 2,400 active clients. Full features for established businesses.

Scaling: Add team members at $20/month each, add 100 client slots for $20/month. 30-day free trial available. Save 20% with annual billing.

Start Your Credit Repair BusinessUse Cases

Starting a Credit Repair Business

Entrepreneurs launching new credit repair companies find Credit Repair Cloud provides the complete infrastructure to begin serving clients immediately. The training resources teach industry fundamentals while the software handles the technical complexity of dispute management. Many users generate their first paying clients within 30 days of signing up.

Credit Repair Consultants

Independent consultants use the platform to professionalize their services. Instead of manually tracking disputes and client communications, consultants leverage automation to handle more clients without sacrificing quality. The branded client portal adds legitimacy that helps justify premium pricing.

Financial Service Expansion

Mortgage brokers, real estate agents, and financial advisors add credit repair services to their existing practices. Credit Repair Cloud integrates with current workflows, enabling these professionals to serve clients who need credit improvement before qualifying for loans or home purchases.

Scaling Existing Operations

Established credit repair companies migrate to Credit Repair Cloud for better automation and reporting. The platform handles growth from dozens to thousands of clients without proportional increases in administrative overhead. Team features enable delegation and quality control as staff expands.

Pros and Cons

Pros

Comprehensive platform: Everything needed to run a credit repair business in one system—no piecing together multiple tools.

Extensive training: Business-building education goes beyond software tutorials to teach marketing, sales, and operations.

Active community: Access to thousands of practitioners sharing strategies, templates, and support.

Proven dispute letters: Library of effective letters developed through millions of disputes across the user base.

Scalable infrastructure: Platform grows with your business from first client to thousands.

Regular updates: Continuous improvements based on user feedback and industry changes.

Cons

Higher price point: Monthly subscription exceeds simpler alternatives, requiring sufficient client volume to justify cost.

Learning curve: Feature-rich platform takes time to master fully.

Overkill for personal use: Designed for businesses, not individuals fixing their own credit.

Client limits on plans: Growing beyond plan capacity requires upgrading to higher tiers.

Credit Repair Cloud vs Competitors

Credit Repair Cloud vs DisputeBee

DisputeBee offers simpler, lower-cost dispute automation. Credit Repair Cloud provides comprehensive business infrastructure. DisputeBee for basic disputes; Credit Repair Cloud for building a business.

Credit Repair Cloud vs Manual Processes

Manual credit repair limits scalability and increases error risk. Credit Repair Cloud automation justifies the subscription for serious practitioners.

Tips for Success with Credit Repair Cloud

Complete the training first: Invest time in the Credit Hero Challenge before taking clients. The structured program builds competence and confidence.

Customize your client portal: Brand the portal with your logo and colors. Professional appearance justifies premium pricing.

Master the dispute letters: Learn which letters work best for different situations. Understanding the letter library maximizes removal rates.

Build affiliate relationships early: Partner with realtors, car dealers, and lenders who encounter clients with credit issues. Referral partnerships provide consistent lead flow.

Track your metrics: Use the reporting dashboard to identify what is working. Data-driven decisions accelerate growth.

Engage with the community: Join the Facebook group and attend webinars. Learning from experienced practitioners shortcuts the growth process.

Frequently Asked Questions

Do I need a license to start a credit repair business?

Requirements vary by state. Credit Repair Cloud provides state-specific guidance, but consult local regulations and consider legal advice before launching.

How long before I can get my first client?

Many users acquire their first paying client within 30 days using the Credit Hero Challenge methodology. Results depend on marketing effort and local market conditions.

Can I use Credit Repair Cloud for my own credit?

The platform is designed for business use. For personal credit repair, consumer-focused tools like DisputeBee offer more appropriate pricing.

What happens if I exceed my client limit?

You can add 100 client slots for $20/month without changing plans, or upgrade to a higher tier for additional team members and features.

Is there a contract or can I cancel anytime?

Monthly plans have no long-term commitment. Cancel anytime, though annual billing provides 20% savings for committed users.

Does Credit Repair Cloud guarantee results for clients?

No credit repair software guarantees outcomes. Results depend on the accuracy of disputed items and creditor responses. The platform optimizes the process but cannot control external parties.

Final Verdict

Credit Repair Cloud delivers the complete package for credit repair businesses—from dispute automation to client management to training. The platform comprehensive approach justifies its premium pricing for entrepreneurs serious about building sustainable credit repair businesses.

The combination of proven systems, extensive training, and active community creates advantages difficult to replicate with alternative solutions. For those committed to the credit repair industry, Credit Repair Cloud represents the investment that separates hobbyists from professionals.

Rating: 4.5/5